When selling your business becomes a consideration, your job quickly turns from looking at your business from the operator lens to the investor lens.

Investors look for how companies generate value. This can be articulated in many forms such as financial returns, strategic value, unique attributes that are near impossible to reproduce.

All of these attributes should tie to real tangible results that you can get behind and prove.

Buyers need to see growth and stability before they invest. Otherwise, they move on to the next opportunity.

That is why uncovering your value drivers will go a long way to help you de-risk the business, show it’s Quality of Earnings and move the conversation forward with prospective buyers.

Showcasing your business’ value drivers will put in the box seat to snag a deal and close it out.

What are Business Value Drivers?

Your value drivers are the primary reason your business makes a profit. They come from your competitive advantage and core capabilities as a business to deliver the quality and experiences your customers like and appreciate.

When you know how they all interact with each other you can start to stack them together. Your valuation compounds. Resulting in a business with a consistent growth rate and a significant balance sheet.

How to Identify Key Value Drivers

Most people get sales, and profitability is vital to building business value. However, as you reach a specific size and scale, managing other value drivers (operational efficiency and capital efficiency) becomes critical as well.

As a business, you need to get the balance right between Risk, Return on Investment, and Cash flows.

Your company’s financials will always tell the story about which metrics drive the most value. For example, revenue growth and margin expansion will likely be more critical than operational efficiency if you’re a retailer.

If you start with your financials, you can track all the metrics behind them so you can see what is driving results or fix whatever isn’t working.

Business driver analysis is how you identify and direct your attention to the activities that impact profitability.

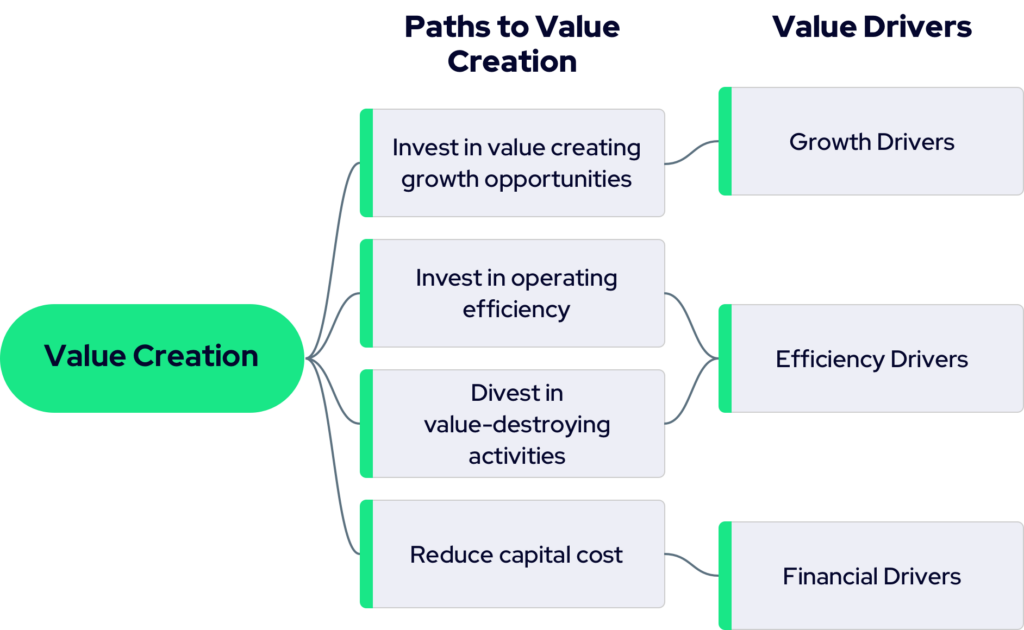

Linking Value Drivers to Value Creation

The Four Business Value Drivers that Close Deals

Revenue Growth

Revenue growth is obvious, and buyers use this metric to screen acquisition opportunities. If you can’t demonstrate topline growth, it’s hard to sell the business.

When owners approach us to help them sell, we see sales going sideways or declining. These businesses don’t connect their offerings to the customer’s and market’s needs and often have poor distribution.

Topline growth results from winning new customers; they keep buying and referring their family and friends. The size of your business is a result of how well you execute all three. It shows a buyer that the business is well run and that its offerings keep stacking up well against competitors.

Consistent and predictable revenue growth is what buyers love.

Key Metrics

- Annual Recurring Revenue $

- Expansion Revenue $

Margin Expansion

What is the trend on your bottom line?

EBITDA as a proxy for earnings is the most common screen buyers use. No matter your industry or business model, earnings below $500,000 pose risk concerns. Using guesswork around pricing or overusing discounts to win customers decreases EBITDA. If your topline growth is impressive, but your margins are razor-thin, you won’t have an attractive business to sell.

By monitoring gross margins religiously, you will start to see patterns. They need to be showing improvement and increase at a higher rate than your total costs. Expanding operating margins shows the buyer the business can grow sustainably with little additional capital.

If a buyer has to put more money into the business later on, they will offer you less money to buy it.

With your EBITDA trending positive you will attract a buyer.

Key Metrics

- Gross Margin %

- Net Margin %

Operational Efficiency

Your operational efficiency shows your ability to produce products and deliver services at a lower cost than competitors. You can achieve this by improving labour productivity, reducing waste or implementing cost-saving measures.

Winding back cost structures is difficult, so efficiency is best gained through proper systemisation and creating the right processes. Combine this with topline growth and margin expansion and you are driving shareholder value. Making you a sought-after acquisition target, not just another business for sale.

Some tips for improving efficiency:

What processes and systems are currently in place - are your staff doing things consistently or ad hoc in the value chain i.e. marketing, sales, operations, fulfillment, etc?

What is everybody doing all day - are the right people in the right job productive and happy?

What do they contribute - is there any duplication of tasks or activities? Could their time be reallocated to more revenue-generating activities?

When you’re efficient, your company is not only more productive, but it’s also profitable.

Key Metrics

- Gross Profit Margin Ratio

- Salary-Wages Margin Ratio

Capital Efficiency

Being capital-efficient is a sign of a well-run business. With a healthy balance sheet, your company is more straightforward to transact.

Buyers will use a number of metrics to review your company’s capital efficiency such as your cash conversion cycle, burn rate, ROCE, etc…

Smaller companies don’t operate with an endless pot of money. You need to make accommodations and provisions for the company to finance its operations and invest in assets to grow.

Showing you are capital efficient will impress a buyer. Because they know for every dollar they put in they get 2-3X back.

When you optimize capital efficiency, the business compounds money on its own. If an acquirer has to pick between a business with higher margins but less capital requirements, they will choose the business that needs the least amount of money to grow. Because buyers know growth can only be fueled by continued investment – you need cash on your balance sheet to do this.

Key Metrics

- Break-Even Point

- Sustainable Growth Ratio

Understanding Value Drivers

Each value driver builds your valuation and opens discussions with buyers who can see there is an attractive business with a straightforward entry point to do a deal.

If you build a tracking system across these key areas you prioritize your inititatives and direct resources to where they’re needed so you can move your valuation higher and give buyers the data points to make an investment decision.

Its simple. The more profitable and sustainable your business is and the less money you need to run it, puts you at the front of que to close a deal.

Looking for M&A Expertise to Drive Your Valuation and Help You Find the Right Buyer?

Our M&A Advisory solutions are built to support your exit aspirations and maximize value by transitioning your business from one owner to the next.

Find out what your business is worth.