Executive Summary

A summary of the key takeaways and recommendations – your business’ current value, risk profile, industry multiples, and recommendations for increasing your sale price.

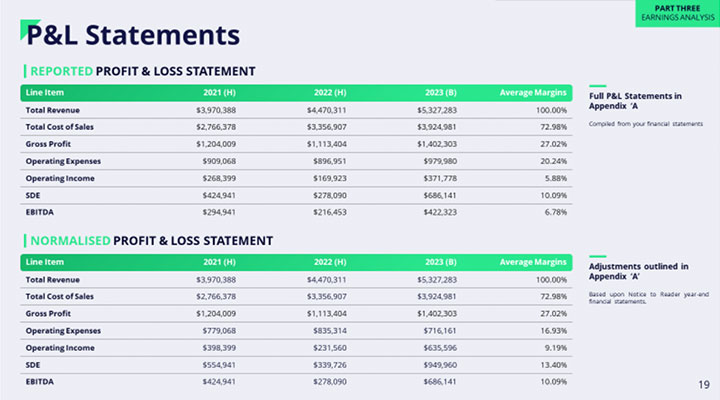

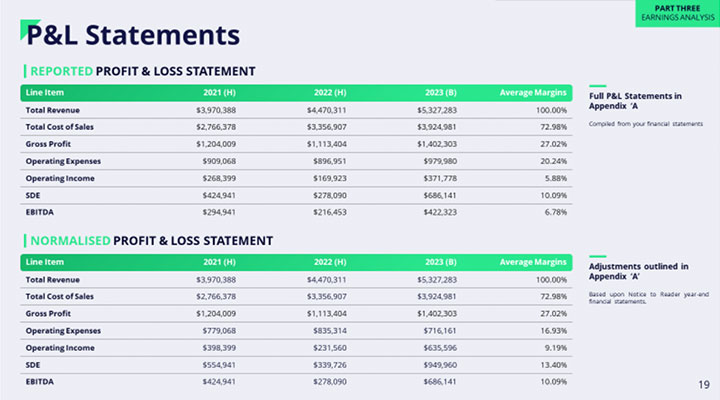

Earnings

Our analysts normalise (adjust) your reported financials based on certain parameters to identify the true profitability of your business.

This normalisation process is standard practice for business sales and buyers expect it.

Risk

The primary reason why businesses don’t sell is because the returns do not offset the risks associated with the company.

Where risk is identified, it is easier to reduce risk than increase returns.

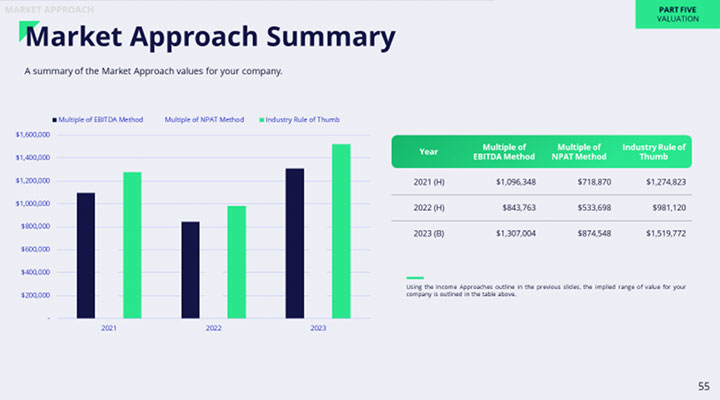

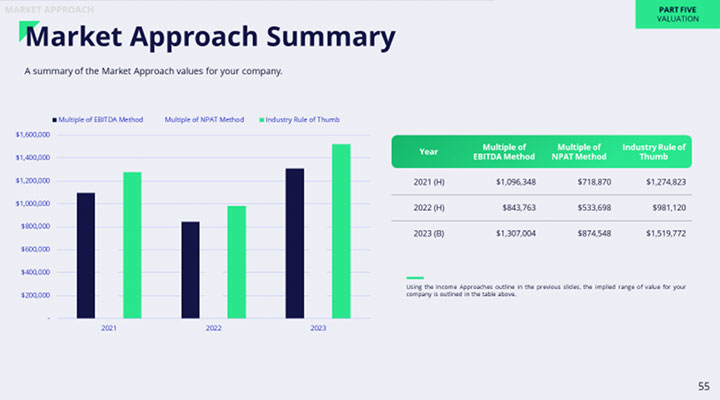

Valuation

This section of the report compares eleven different valuation methodologies to determine the market value of your business.

Market Value

This section outlines the range of values that buyers will be willing to pay for your business.

Buyer Insights

Not all buyers are created equally.

This section aims to educate you about buyers in the market, the pros and cons of each, how much they are likely to pay, and how they typically structure deals.

Value Enhancement

This section outlines clear steps to reduce risk in various areas, with the objective of increasing value.

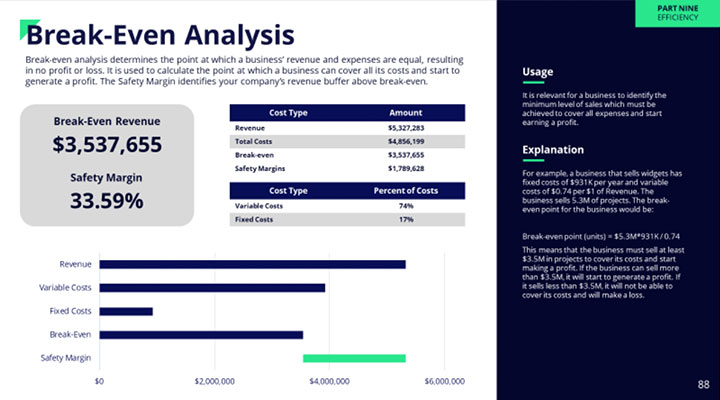

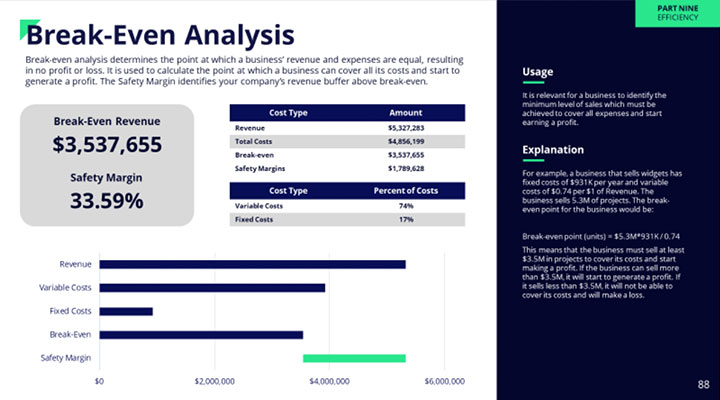

Efficiency

We will benchmark your business to similar companies, run a break-even and sustainable growth rate analysis.

Over 20 industry ratios are used to grade your business on efficiency.

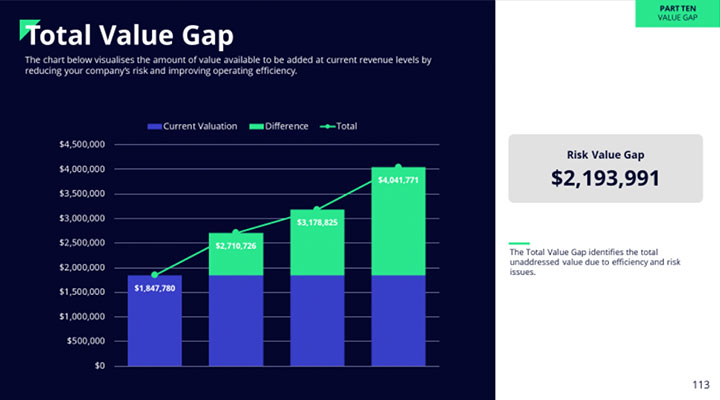

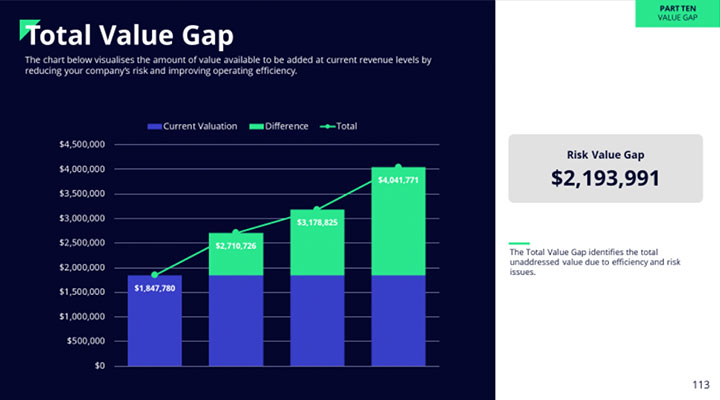

Value Gap

Using the findings in Part 9, we identify how much money will be left on the table at the time of sale if you don’t fix certain issues before selling. This one is an eye opener.

Cash at Close

This section calculates how much cash you will walk away with upon closing, after all transaction costs.